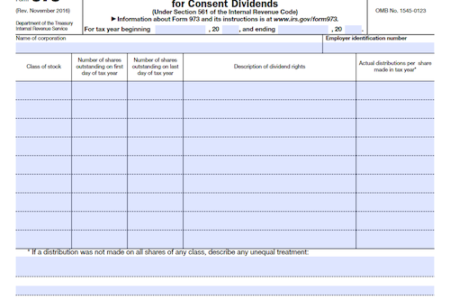

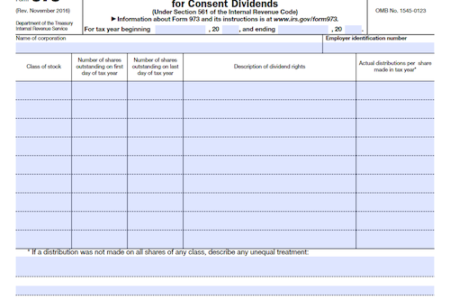

IRS Form 973 is a document used to report the transfer of a deceased person’s interest in a qualified revocable trust to a qualified beneficiary. It is also utilized to …

IRS Form 973 is a document used to report the transfer of a deceased person’s interest in a qualified revocable trust to a qualified beneficiary. It is also utilized to …

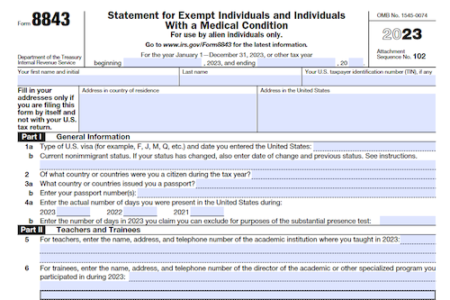

Nonresident aliens are required to file Form 8843 in order to report their presence in the United States during the applicable tax year and to claim an exemption from U.S. …

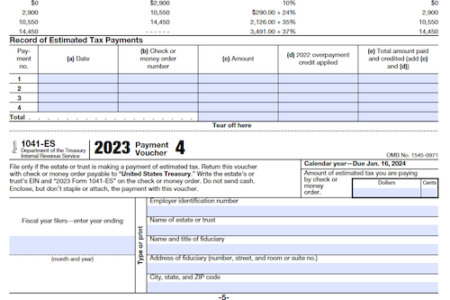

Form 1041-ES is an estimated tax form used by certain fiduciaries to pay estimated taxes on behalf of a trust or estate. It is used to calculate and pay taxes …

Filing Form SS-4 with the Internal Revenue Service (IRS) is an essential step for employers, sole proprietors, corporations, partnerships, trusts, estates, churches, government agencies, certain individuals, and other entities in …

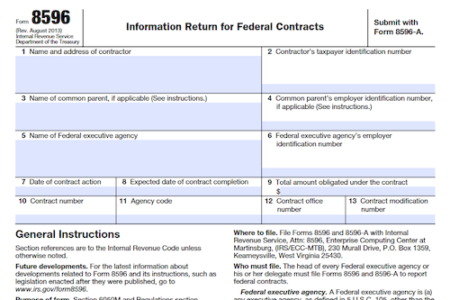

Federal executive agencies and their delegates must file Forms 8596 and 8596-A with the IRS each quarter to report federal contracts and increases in contract obligations. Special rules, exceptions, and …

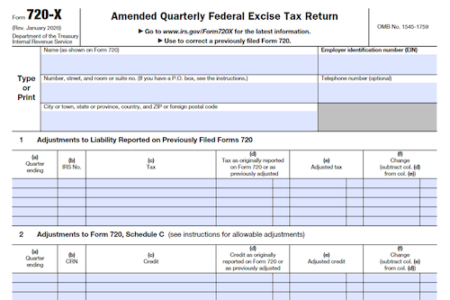

Businesses dealing in goods or services subject to federal excise taxes must complete and file form 720 with the IRS on a quarterly basis. The form details how much excise …

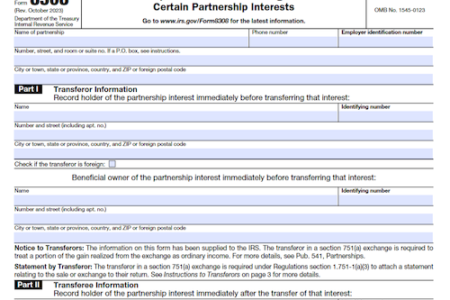

Form 8308 is used for various reporting purposes, including the transfer of a life insurance contract, closely held business, or a partnership interest between related persons. It also reports the …

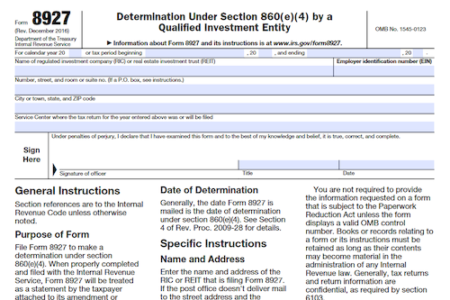

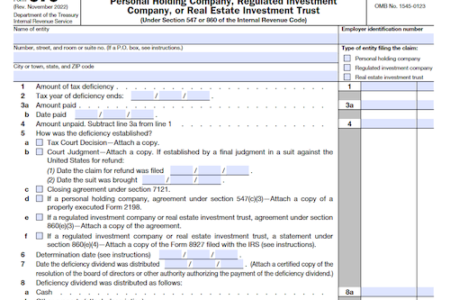

When a Real Estate Investment Trust (REIT) or Regulated Investment Company (RIC) seeks to make a self-determination under section 860(e)(4), they must file Form 8927 with the Internal Revenue Service. …

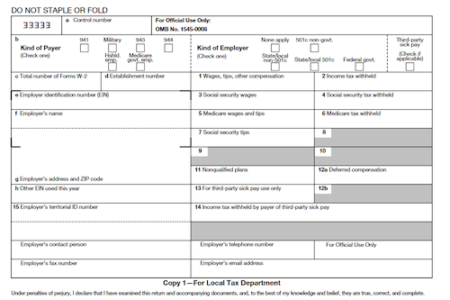

Form W-3SS is an essential requirement for employers in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands to accurately report wage and tax …

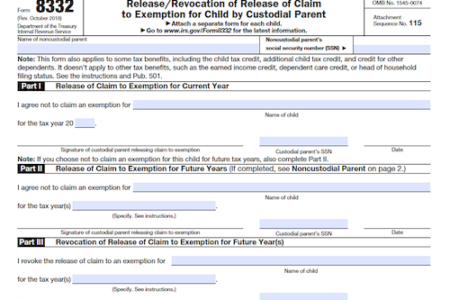

Form 8332 is a form used in cases of divorce or separation when the release of the custodial parent’s right to claim a child as a dependent is given to …

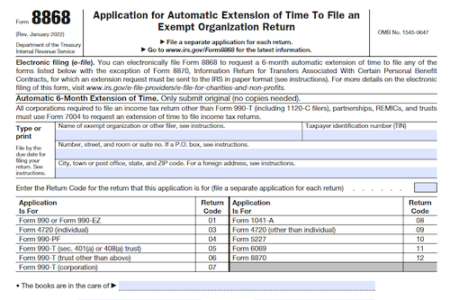

Learn how to properly file Form 8868 for an extension to file tax returns for exempt organizations. Understand the rules for tax payments, filing penalties, and reasonable cause determinations, to …

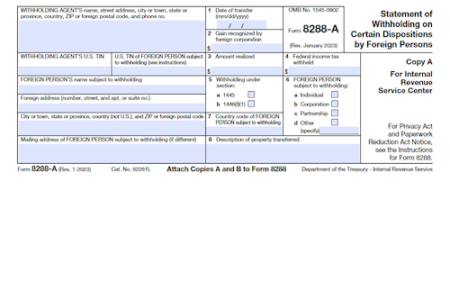

When real estate in the US is purchased by a foreign person, filing Form 8288 and 8288-A are required to report and pay the FIRPTA tax withholding. Knowing what information …

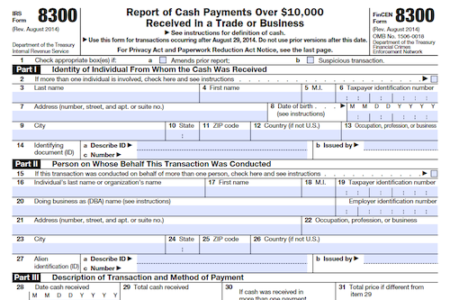

Businesses must file Form 8300 with the IRS if they receive more than $10,000 in cash in a single transaction or two related transactions. Casinos also must file Form 8300 …

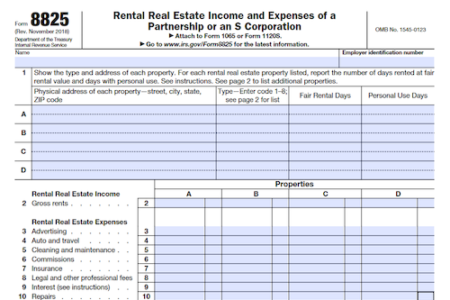

Form 8825 is used by partnerships and S corporations to report income and deductible expenses from rental real estate activities, as well as to compute a potential business interest expense …

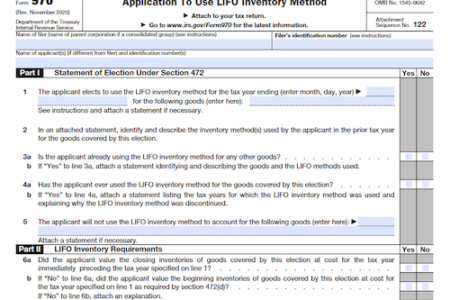

This article covers instructions for completing Form 970, which is filed with a taxpayer’s income tax return to elect to use the Last-In, First-Out (LIFO) inventory method under Section 472 …

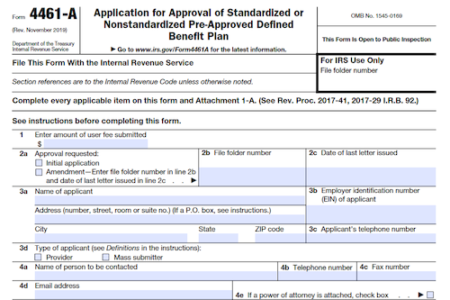

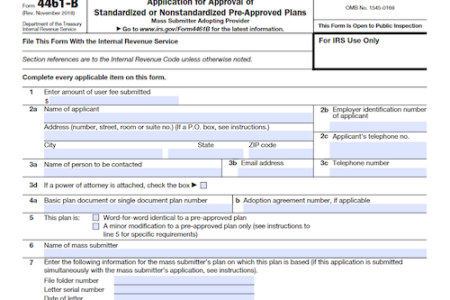

Form 4461-A is used to apply for the approval of standardized and nonstandardized pre-approved defined benefit plans. Learn more about the filing and submission process to apply for approval, as …

Form 4461-A is used to apply for approval of standardized or nonstandardized pre-approved defined benefit plans from the IRS. The application must be accompanied by additional documents, such as a …

Taxpayers who produce, grow, or extract qualified production activities income (QPAI) within the United States may be eligible to claim the Domestic Production Activities Deduction (DPAD), which is calculated using …

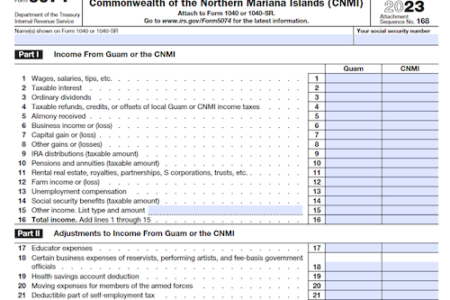

Filing Form 5074 is required for U.S. citizens or resident aliens reporting at least $50,000 in Adjusted Gross Income (AGI) and $5,000 or more from Guam or CNMI sources. Learn …

Adoptive parents and legal guardians need to complete Form 976, Application for Taxpayer Identification Number for Pending U.S. Adoptions, in order to obtain a Taxpayer Identification Number (TIN) for a …