Form 1095-B is an IRS document that shows taxpayers, their spouses, and dependents if covered, information about their health care coverage under the Affordable Care Act (ACA). Its purpose is …

Form 1095-B is an IRS document that shows taxpayers, their spouses, and dependents if covered, information about their health care coverage under the Affordable Care Act (ACA). Its purpose is …

IRS Form 8821, Tax Information Authorization, is a single page document used to grant permission for any type of tax filing for any given year to a person or company, …

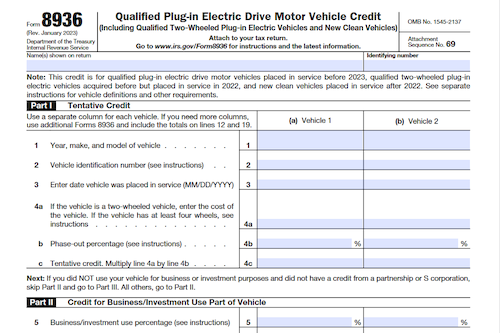

Are you thinking of purchasing an electric vehicle in 2022? If so, you may be eligible for a tax credit! The Internal Revenue Service (IRS) offers tax credits up to …

Form 1095-C: Employer-Provided Health Insurance Offer and Coverage is an IRS tax form used to report information about an employee’s health coverage offered by an Applicable Large Employer (ALE). It’s …

IRS Form 8962 is a form used to calculate the amount of premium tax credit you’re eligible to receive, or determine if you owe money to the Internal Revenue Service …

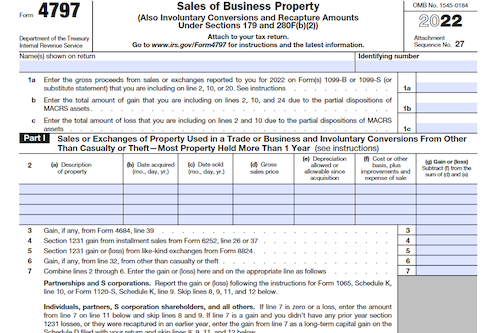

Form 4797 is a tax form issued by the IRS and used to report financial gains made from the sale or exchange of business property, including property used to generate …

Form 2848: Power of Attorney and Declaration of Representative is an Internal Revenue Service (IRS) document that authorizes an individual or organization to represent a taxpayer by appearing before the …

Gambling winnings must be reported as income to the IRS, and Form W-2G is the document that gambling establishments send to customers who had winnings during the prior year. This …

Form 9465: Installment Agreement Request is an official document provided by the Internal Revenue Service (IRS) for taxpayers who find themselves unable to make a lump sum payment for their …

Form 4684 is an IRS form used to report losses from casualties and thefts that may be deductible for taxpayers who itemize deductions, such as disasters and thefts resulting from …

Form 4506, Request for Copy of Tax Return, is a form filed by taxpayers to request exact copies of one or more previously filed tax returns and other tax information …

Form 4952: Investment Interest Expense Deduction is a tax form used by the IRS to determine the amount of investment interest expense that can be deducted and any interest expense …

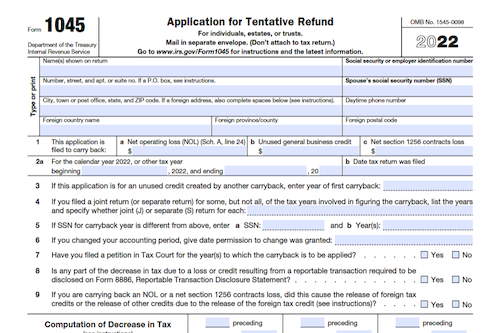

Are there any questions about what Form 1045: Application for Tentative Refund is or how to file it? What is Form 1045? Form 1045: Application for Tentative Refund is an …

Form 1098 is an IRS form that shows how much interest you have paid in one year on a qualified home mortgage. It can be used to figure out a …

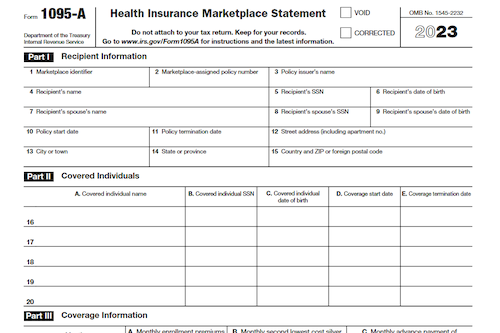

It is important to be aware of Form 1095-A: Health Insurance Marketplace Statement and its role in your life. This form is sent to Americans who obtained health insurance coverage …

Every business entity needs an employer identification number (EIN) to operate and keep personal finances separate from business ones. The EIN is issued by the IRS for free and can …

Form 1310 is an IRS form used to claim a federal tax refund for beneficiaries of a recently deceased taxpayer. It can be filed by the surviving spouse, another beneficiary, …

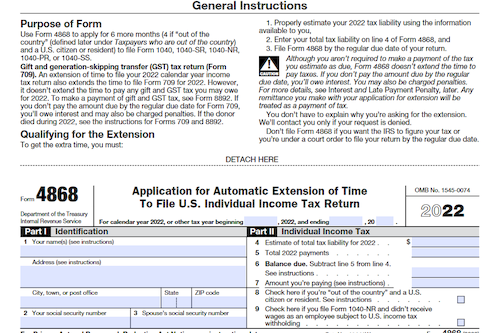

Taxpayers who need more time to file a federal income tax return can use Form 4868 to get a 6-month extension – however, it does not extend the time to …

Form 1040-SR is a tax return form designed specifically for taxpayers over the age of 65. It is virtually identical to the standard 1040 form, except it is easier on …

For foreign individuals and entities that receive income in the U.S., W-8 forms are IRS forms used to verify their country of residence for tax purposes, and to claim exempt …