This article provides detailed instructions on Form CT-1, which is used to report taxes imposed by the Railroad Retirement Tax Act (RRTA). It explains who must file Form CT-1, how …

This article provides detailed instructions on Form CT-1, which is used to report taxes imposed by the Railroad Retirement Tax Act (RRTA). It explains who must file Form CT-1, how …

Organizations seeking a miscellaneous determination from the IRS must file Form 8940, which includes providing information about the organization’s past, present, and planned activities, and attaching documents such as a …

This article provides an overview of Form 965-A, detailing the purpose of the form, definitions associated with it, who must file it, and when and where it is to be …

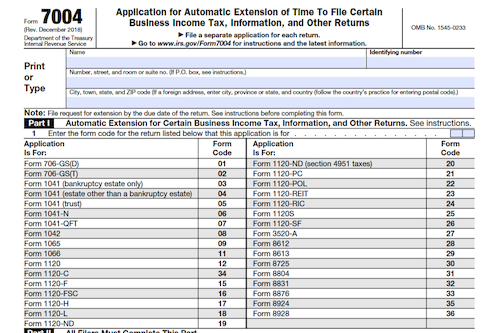

Form 7004 is used to request an automatic extension of time to file certain business income tax, information, and other returns. Properly filing Form 7004 will give you the maximum …

This article will discuss the Form 8941, used by eligible small employers to figure the credit for small employer health insurance premiums. It will also cover the requirements for eligibility, …

Filing Form 940-PR is necessary for employers to report their contribution to the Federal Unemployment Tax Act (FUTA). Most employers have to pay both federal & state unemployment contributions, but …

Lead: Form 8582-CR is used to figure the amount of any passive activity credit, as well as to make the election to increase the basis of credit property, for noncorporate …

Use Form 8910 to figure your credit for alternative motor vehicles placed in service during your tax year, which is treated as either a general business or personal credit. Partnerships …

Form 990-EZ is an annual information return required by the IRS from many organizations exempt from income tax and certain political organizations. The form requires reporting on exempt activities, finances, …

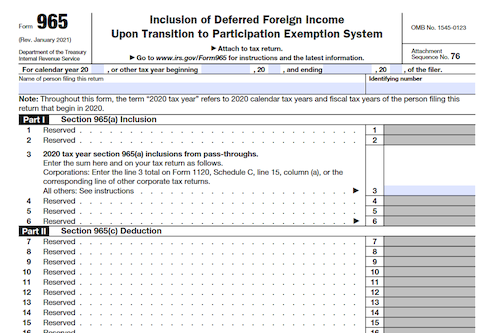

U.S. persons required to report their section 965(a) inclusions, section 965(c) deductions, and applicable percentage for disallowance of foreign taxes for their 2020 tax year must complete Form 965 and, …

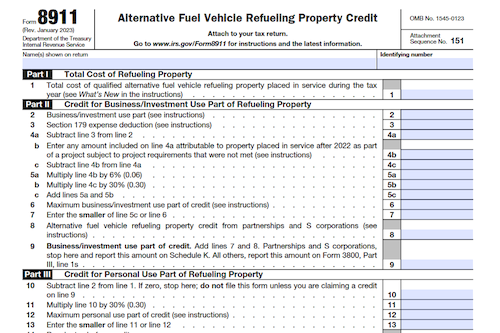

Form 8911 is used by taxpayers to claim credits for the purchase of alternative fuel vehicle refueling property, either as a general business credit or personal credit. Depending on the …

Form 940-PR is used to report an employer’s contribution to the Federal Unemployment Tax Act (FUTA). Most employers pay both state and federal unemployment contributions, and must file the form …

When a trade or business is sold, the transaction must be reported to the IRS by the buyer and seller using Form 8594. This article covers the reporting requirements, penalties, …

Eligible taxpayers can now claim the Railroad Track Maintenance Credit (RTMC) for Qualified Railroad Track Maintenance Expenditures (QRTME), which have been retroactively extended to cover qualified railroad track maintenance expenditures …

Employers in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands (CNMI), and the U.S. Virgin Islands must use Form 941-SS to report the social security and Medicare taxes …

With new Treasury Decisions (T.D.) introduced on March 22, 2021, the IRS has revised certain rules on loss limitation and real property trade or business for noncorporate taxpayers for tax …

Form 3520-A is an annual information return of a foreign trust that must be filed by the foreign trust, and subsequently the U.S. owner, to satisfy its annual information reporting …

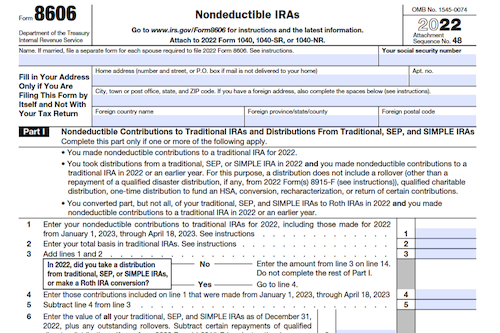

Form 8606 is an important document used for reporting nondeductible contributions to traditional IRAs, distributions from IRAs, conversions from IRAs to Roth IRAs, and distributions from Roth IRAs. Learn who …

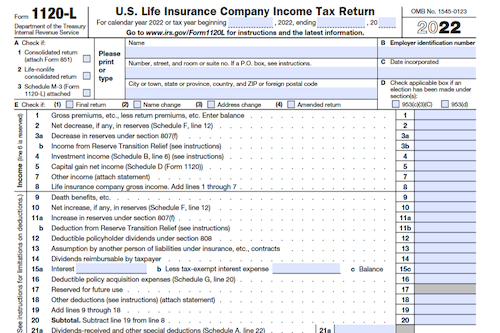

Need to file taxes for a life insurance company? Form 1120-L can help you report income, gains, losses, deductions, and credits, and calculate any associated tax liability. What is Form …

With unearned income over $2,300, parents must use Form 8615 to figure the child’s taxes if the parent’s rate is higher than the child’s. To do this, parents must understand …