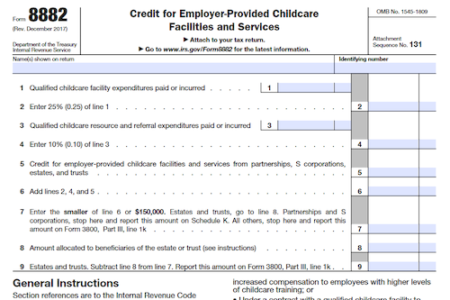

Employers who paid premiums for health insurance coverage for their employees must complete and sign Form 8882 in order to receive a credit and report any recapture of the credit. …

Employers who paid premiums for health insurance coverage for their employees must complete and sign Form 8882 in order to receive a credit and report any recapture of the credit. …

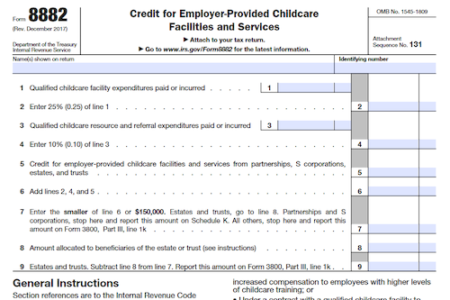

With service jobs often paying hourly, tax time can be a daunting challenge for employees. In order to pay your Social Security and Medicare taxes on tip income, you may …

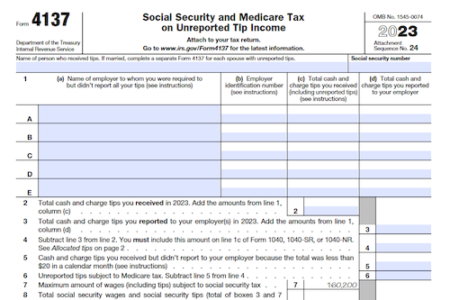

Form 1125-A is an important piece of paperwork for corporations filing their taxes. It provides details about the cost of goods sold and inventory, and is necessary for the accurate …

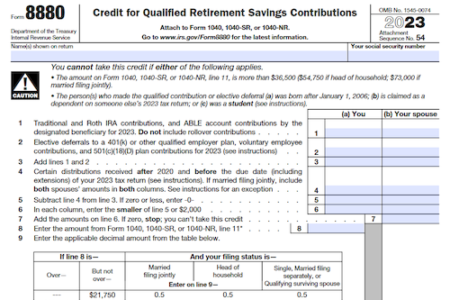

Form 8880 is used to claim the Retirement Savings Contributions Credit, which can be up to $2,000 for eligible taxpayers who make contributions to a qualified retirement plan or IRA. …

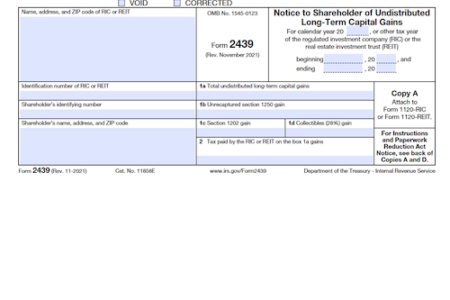

Form 2439 is used to report the amount of undistributed capital gains from a variety of assets, such as stocks, bonds, real estate, and business interests, which have not been …

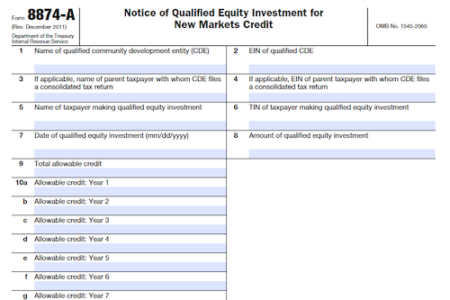

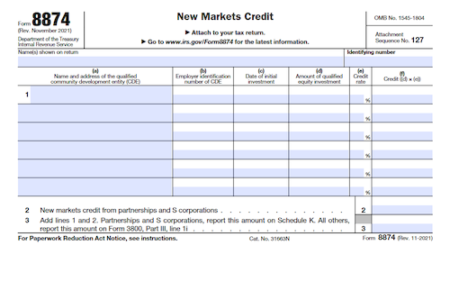

An IRS Form 8874, New Markets Credit, is used by Community Development Entities (CDEs) to provide notice to taxpayers who invest in the CDE, entitling them to the new markets …

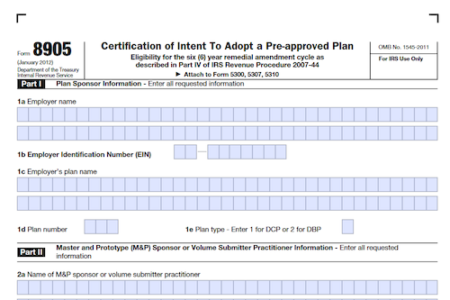

Form 8905 is used by an adopter of an individually designed or pre-approved plan to request that their 5-year remedial amendment cycle be converted to the 6-year cycle, as described …

Filing taxes as a tax-exempt organization can be complicated, but IRS Form 8717 can help. It allows organizations to request up to six months of extra time to file their …

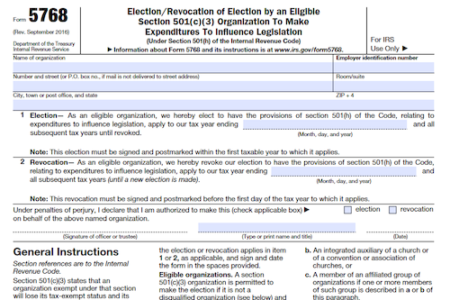

Organizations exempt under section 501(c)(3) of the Internal Revenue Code can elect to make limited expenditures which can influence legislation, with certain restrictions. Organizations must report their actual and allowed …

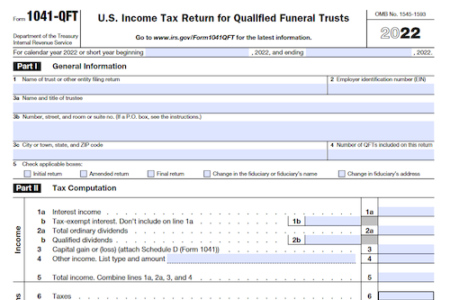

Find out what you need to know in order to properly file Form 1041-QFT to the IRS, including due dates, mailing addresses, who must sign, interest and penalty forms, and …

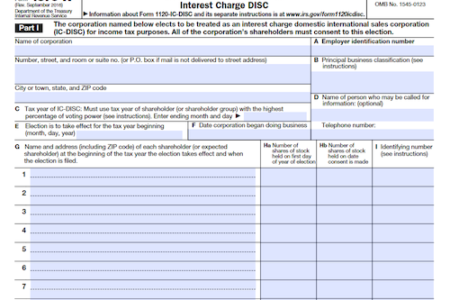

This article explains the necessary steps a corporation must take to make an election to be treated as an Interest Charge Domestic International Sales Corporation (IC-DISC). It describes the eligibility …

Investors looking for information about claiming the New Markets Credit for qualified investments in qualified Community Development Entities (CDEs) can find important details with Form 8874. This form outlines the …

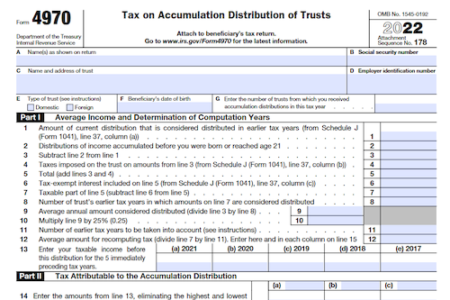

Beneficiaries who received an accumulation distribution from certain domestic trusts created before March 1, 1984, must file Form 4970 to compute any additional tax liability. Foreign trust beneficiaries must use …

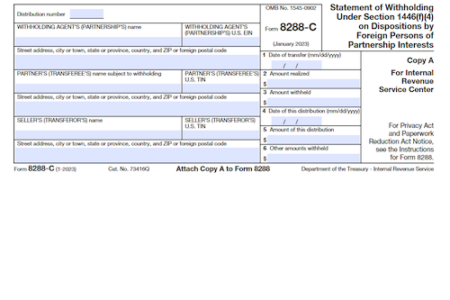

The Form 8288-C is an IRS form used to report the transfer of a U.S. real property interest by a foreign person, and to calculate and report the withholding tax …

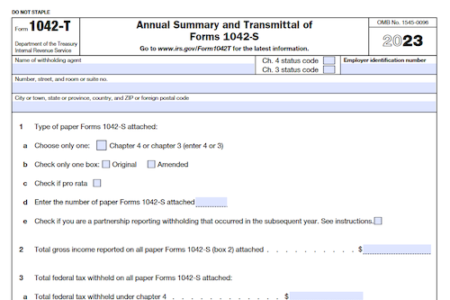

Form 1042-T is used to report U.S. source income payments made to foreign persons, such as wages, salaries, fees, commissions, interest, dividends, royalties, and scholarships or fellowship grants. It is …

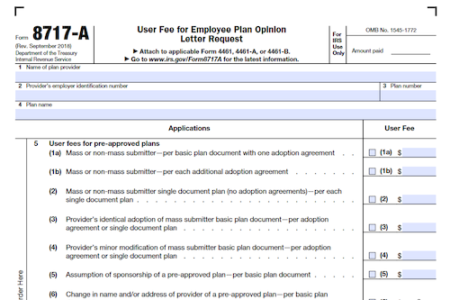

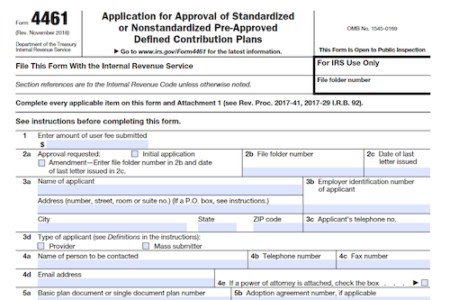

Filing for an IRS pre-approved plan requires Form 4461, which must be accompanied by a user fee and a power of attorney if necessary. Learn more about IRS pre-approved plans …

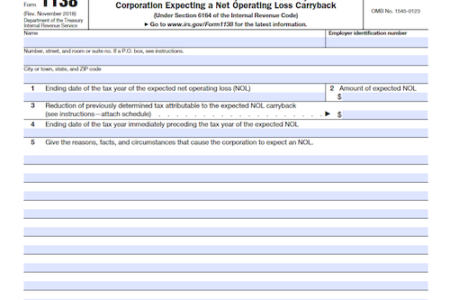

Corporations expecting a Net Operating Loss (NOL) carryback can reduce the amount due for the prior year’s tax with Form 1138: an Extension of Time for Payment of Taxes. This …

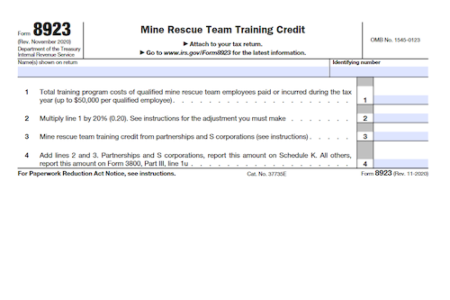

Form 8923 allows taxpayers who employ miners in U.S. underground mines to claim a credit of 20% of the training program costs paid or incurred for training of qualified mine …

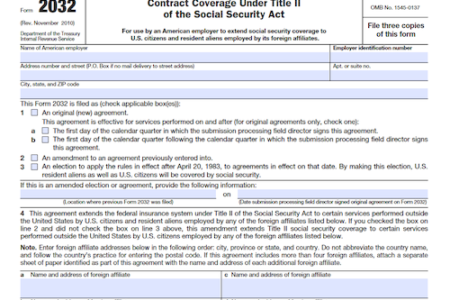

Form 2032 is an application for Contract Coverage Under the Federal Employees’ Compensation Act (FECA) and allows American employers to extend Social Security coverage to U.S. citizens and resident aliens …

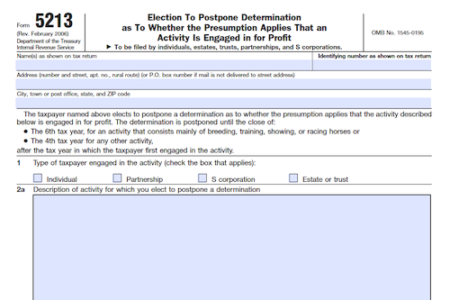

Individuals, estates, trusts, partnerships, and S corporations can use Form 5213 to elect to postpone a determination as to whether they are engaged in an activity for profit and obtain …