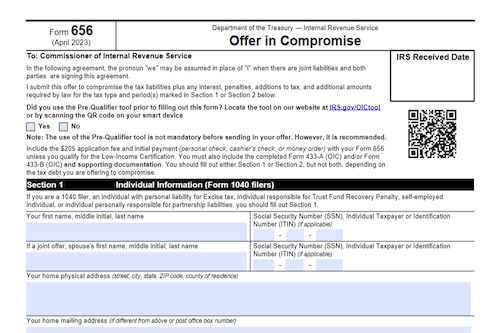

Struggling to pay off debt to the IRS? An IRS Offer in Compromise (Form 656) may provide citizens with the relief they need. Read on to learn more about the …

Struggling to pay off debt to the IRS? An IRS Offer in Compromise (Form 656) may provide citizens with the relief they need. Read on to learn more about the …

IRS Form 1098 is used to report mortgage interest payments ($600 or more) to the IRS. It’s issued by mortgage lenders to homeowners, as well as businesses that have received …

Learn how to complete Form 943, the Employer’s Annual Federal Tax Return for Agricultural Employees, including requirements for filing, step-by-step instructions, and payment methods. This form is due annually on …

Form 1098 is a document used by lenders and businesses to report mortgage interest payments of $600 or more to the IRS. It can also be used to report tuition …

Employers must file IRS Form 945 if they have withheld taxes from certain non-payroll payments, such as qualifying pensions, gambling profits, and military retirement and pay. Form 945 is used …

Form 2553 is an election used to have a business entity recognized as an S corporation for tax purposes—from incorporating to filing—all within deadline or with “reasonable cause”. Learn more …

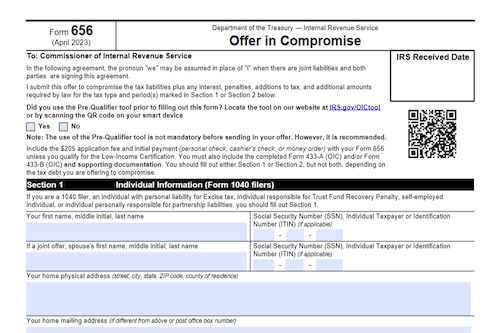

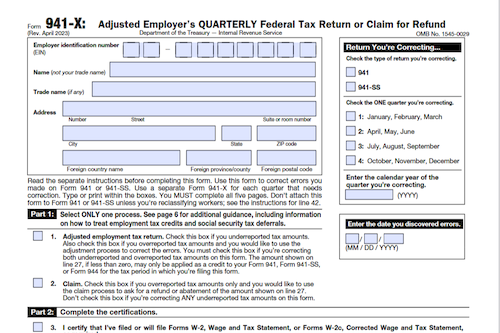

Learn the intricacies of IRS Form 941 and proper filing and correction procedures for COVID-19-related tax credits using Form 941-X, including when to file and what can be corrected. What …

Understand the tax implications of Employee Stock Purchase Plans (ESPPs), which offer a fringe benefit to employees the option to purchase a company’s stock at a discounted rate. ESPPs often …

Have you been considering changing the tax status of your Limited Liability Company (LLC) to a corporation or an S corporation? Learn the process of filing IRS Form 8832 or …

Understanding a business’s fiscal and tax year is important for filing taxes correctly. This article outlines how to determine a fiscal year, how a business fiscal year is different from …

With various methods to update a mailing address with the Internal Revenue Service (IRS) such as Form 8822, your tax return, by phone, in person, or by mail, it’s important …

The foreign tax credit is a credit U.S. taxpayers can use to offset income taxes paid to a foreign government, preventing double taxation on income earned in both the U.S. …

With various methods to update a mailing address with the Internal Revenue Service (IRS) such as Form 8822, your tax return, by phone, in person, or by mail, it’s important …

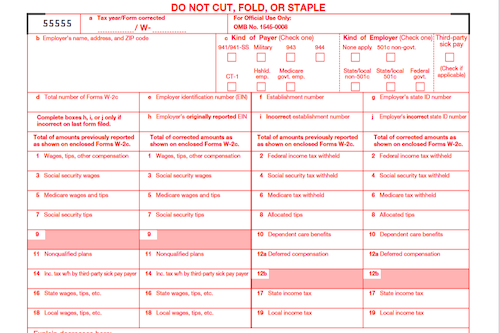

Learn how to correct errors on filed W-2 forms, how to get the forms you need, and the penalties imposed for incorrect information on those forms. What is Form W-3-C? …

From the time of death to the end of a fiduciary relationship, IRS Form 56 must be filed to notify the IRS of changes and to list a fiduciary as …

IRS Form W-3 is an important summary transmittal tax form businesses must file with federal agencies along with annual wage and tax forms for employees. It compiles employee salaries and …

IRS Form 8962 is a form used to calculate the amount of premium tax credit you’re eligible to receive, or determine if you owe money to the Internal Revenue Service …

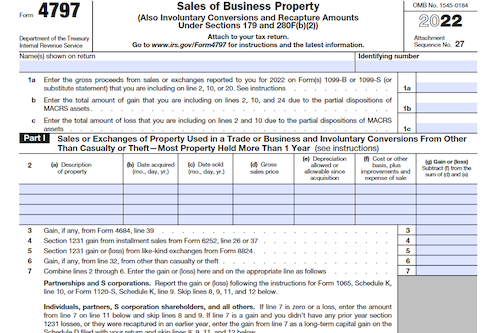

Form 4797 is a tax form issued by the IRS and used to report financial gains made from the sale or exchange of business property, including property used to generate …

Form 2848: Power of Attorney and Declaration of Representative is an Internal Revenue Service (IRS) document that authorizes an individual or organization to represent a taxpayer by appearing before the …

Gambling winnings must be reported as income to the IRS, and Form W-2G is the document that gambling establishments send to customers who had winnings during the prior year. This …