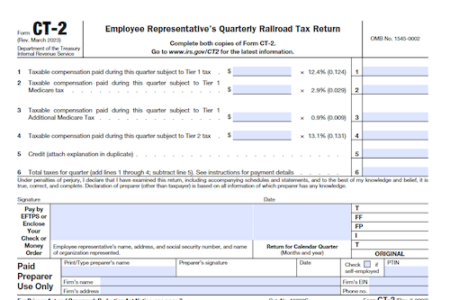

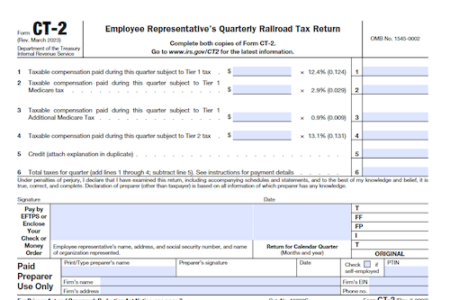

Form CT-2, issued by the Internal Revenue Service (IRS), is a federal corporate income tax form used to report the railroad retirement taxes imposed on the compensation received by designated …

Form CT-2, issued by the Internal Revenue Service (IRS), is a federal corporate income tax form used to report the railroad retirement taxes imposed on the compensation received by designated …

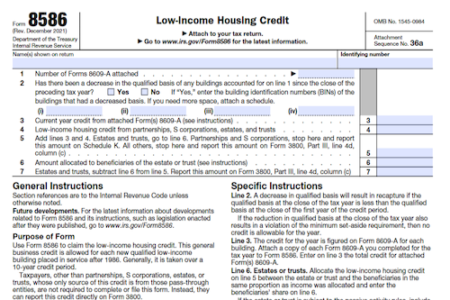

Pass-through entities, such as partnerships, S corporations, estates, and trusts, can claim the low-income housing credit on Form 8586, although individual taxpayers are not required to complete the form. Owners …

Businesses and organizations conducting wagers or lotteries must file Form 730 and pay the associated tax to the Department of Treasury. Learn here how to properly complete Form 730 and …

The IRS Form 8949 is used to report the gain or loss from the sale or exchange of a wide variety of capital assets, such as stocks, bonds, mutual funds, …

For taxpayers wishing to report income earned in a foreign country and claim exclusions, deductions, and exemptions, Form 2063 offers a means to do so. This form can be used …

Form 8826 can be used by eligible small businesses to claim the disabled access credit, a part of the general business credit. This form details instructions and definitions related to …

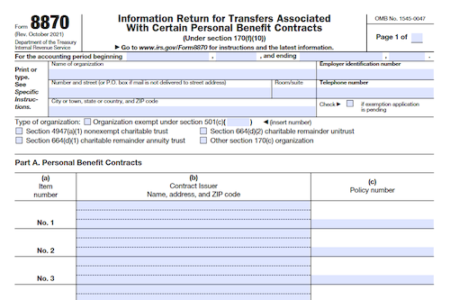

This article provides an overview of Form 8870, which is required to be filed by charitable organizations who paid premiums on certain life insurance, annuity, and/or endowment contracts after February …