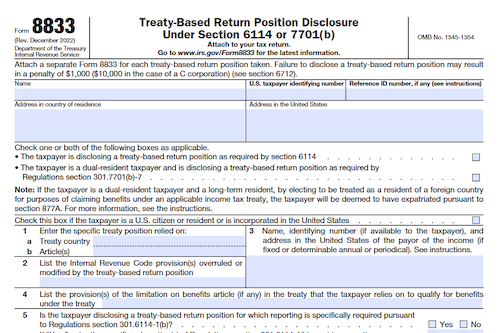

Form 8833 is a valuable tool for US taxpayers to claim treaty benefits on income that is subject to US tax. With Form 8833, taxpayers can report treaty-based positions taken on US income tax returns, including those not reported on other forms or schedules.

What is Form 8833?

Form 8833 is a document required for individuals claiming treaty-related benefits on income subject to U.S. taxation. This form can be used to officially declare positions taken on a U.S. tax return, which were otherwise not reported on other forms or schedules. By filing Form 8833, one ensures that the contemplated treaty-based tax positions are properly reported and taken into account.

IRS Form 8833 – Who Needs to Fill It Out?

IRS Form 8833 is to be filled out if a taxpayer wishes to claim treaty benefits on income subject to taxation by the United States. It is used to report treaty-based positions taken on the U.S. income tax return, which may not be reported on other forms or schedules. The form is also used to report treaty-based positions taken on a U.S. income tax return that are not reported on other forms or schedules, such as deductions or credits. Therefore, anyone claiming treaty benefits should fill out this form to receive the appropriate tax benefits.

Step-by-Step: Form 8833 Instructions For Filling Out the Document

Form 8833 is an essential document if you are wanting to claim tax benefits based on a treaty between the US and another country. The form must be filled out accurately and completely as it is used to report treaty-based positions taken on a US income tax return which are not reported on other forms or schedules. It is important to make sure that the form is filed correctly and with all necessary information so that the benefits can be claimed correctly. As such, instructions should be followed carefully and the form should be completed accurately.

Below, we present a table that will help you understand how to fill out Form 8833.

| Information Required for Form 8833 | Details |

|---|---|

| Treaty-Based Positions | Report treaty-based positions on a US income tax return |

| Accuracy and Completeness | Fill out the form accurately and completely |

Do You Need to File Form 8833 Each Year?

Form 8833 is necessary for those individuals claiming treaty benefits, which apply to income subject to U.S. tax. It must be completed annually to accurately report treaty-based positions taken on a return. It is not reported on other forms or schedules, so it is essential for all those individuals who claim treaty benefits to fill out the form and submit it each year.

Download the official IRS Form 8833 PDF

On the official IRS website, you will find a link to download Form 8833. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8833

Sources: